How to Choose the Right Insurance: A Comprehensive Guide

How to Choose the Right Insurance

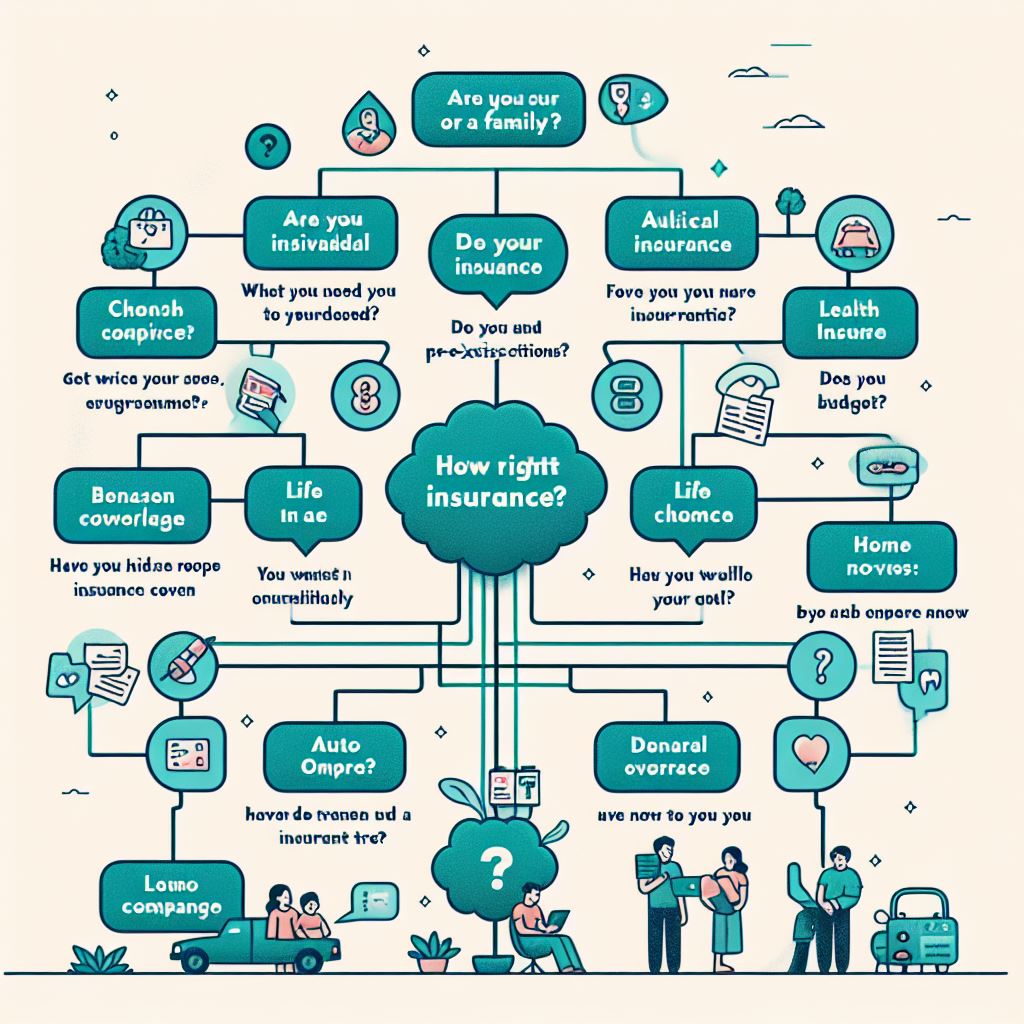

If you want to continue on your journey of choosing the best insurance plan, be it for your health, home, car, or business, you need to be meticulous in your decisions to help you find the right plan and give you peace of mind and financial wellness. Today, we’ll walk you through this all-encompassing guide and discuss the fundamental elements and forethoughts to keep in mind for you to confidently arrive at the right insurance decision.

Assessing your needs

The very first thing is to determine your precise needs and your present situation as the primary step in making the right insurance choice. Spend the time necessary to see where you are in your life now and where you would like to be later and determine all potential risks involved in your plan. Consider items like age, marital status, family size, assets, and income, because they will guide you in the very next step by helping you determine what types of coverage you need. Identifying yourself and your peculiar demands will assist you in reducing the types of insurance plans you can take and the kind of protection that you can provide.

Researching insurance providers

The next step after realizing what kind of insurance you would want to have is to take advantage of various resources and incorporate their help in understanding more about different providers and insurance policies. Search for a trustworthy firm whose financial condition is well-rated, where customer service is good, and where filing claims, if need be, is quick and straightforward. Look at online reviews, ask your friends and family members, and get suggestions from trustworthy sources. Write a balanced sentence on the given topic using the keyword “sophistication.”.

Comparing coverage and premiums

Selecting the best insurance frequently means achieving the right balance between the coverage level and the premium (you have to pay to get it) rate. To complete the evaluation, you should consider the limitations of coverage, deductibles, co-payments, and the existence of exclusions. You should make sure they meet your requirements and budget. Keep in mind that, in the long run, the cheapest option may not ensure the maximal level of safety; therefore, before you make a final choice, think of all the cons of the economical option.

Understanding policy details

Get acquainted with and comprehend the conditions and terms evidently in the agreement before signing for the insurance plan. Examine carefully the fine print encompassing disclosure, exclusions, limitations, and periods. Become acquainted with when you make a claim, when you renew your policy and any potential changes in your policy calculations or payments.

Bundling and discounts

A majority of insurance agencies provide lower rates for securing several kinds of insurance coverage or achieving certain standards, such as safe driving or protecting the property with technological devices. Specifically, take the time to research these discounts and find out how you can get discounts by fulfilling certain requirements if you want to get comprehensive coverage while saving money.

Reviewing and updating regularly

Things in life can often happen very quickly, and you may need more or different life insurance. One must review their insurance coverage regularly, especially once a year, if there are no significant life events or when they occur, such as marriage, parenthood, buying a new home, and so on. When it comes to the policies, it is of utmost importance that you make them work for you and adapt them to your new circumstances. This can help you get all the levels of protection you need and avoid both overpayment and underinsurance.

Conclusion

Choosing the right insurance is quite a task, as it is crucial and requires proper attention and research. Through your evaluation of your needs, giving attention to the classification of insurance, looking at the various providers and likely policies, and making a point of reviewing your policies periodically, you can confidently go through the insurance terrain. The relevant insurance will not only ensure the security of your finances but also make a huge difference as far as giving you that mental relief and allowing you to concentrate on things that truly matter in your life.

Rules and regulations

Among other things, it is important to have a good understanding of the law regarding insurance when you make an underwriting decision. These norms do serve two main purposes. First of all, they protect clients through the provision of a reasonable framework. Secondly, they promote strong regulation of insurers in terms of clarity as well as fairness.

State Insurance Regulations: Insurance is… differentiates the insurance industry, as each state has its laws and policies that brand it as an insurance company. Get aware of the regulations in your state in particular, as they could impede coverage types, policy requirements, and consumers.

Disclosure Requirements: Inspection companies list policies necessary for consumers that include the details of the policy, exclusions, and the condition for the increase in the overnight rate. It ties the chain of command or the responsibility of each role, so there is no tolerance for misconduct.

Claims Processing: Plenty of regulations are available for use during the claim process, including insurers’ timelines to respond and process claims and provisions for appealing denied claims.

Premium Rate Regulation: Some regulatory agencies check the premium rates’ compliance with the anti-discrimination provisions and the norms of law to restrict high or discriminatory prices in certain states.

Financial Solvency Requirements: The insurance companies should keep sufficient amounts of capital and reserves at set levels to make sure they can discharge debts and stay financially strong.

Through knowledge of these rules and regulations, you will learn how to make good sense of the insurance system, defend your rights as a consumer, and be conscious of selecting reputable and legal insurance providers.

You must realize that picking out the right insurance for you is a continuous process; therefore, make sure that you do a regular evaluation and use this time to make the necessary changes when there are such changes in your circumstances. Through your conscious participation in the process, including studying the situation, gathering reviews about different providers, and working closely with health insurance advisors, you can be sure you are protected and will be confident about your outcome.

FAQs

“What can I do to make sure I will get the most affordable insurance rates?”

To have the most affordable prices, you have to ask around and request quotations from more than one insurance company. Further, ask them about discounts available if you can buy other policies at the same time if you are a good driver, or if you buy a security system for your house. In addition, you can potentially enjoy lower insurance costs if you can keep your credit score good.

How can I handle my case when the dimension of my insurance changes easily?

One of the crucial safety actions is talking with your insurance provider regarding your needs. For instance, if there tends to be a significant change in your life, let’s say a marriage, starting to parent, or getting a new job, then do not hesitate to update your policy. Forgetting to renovate your insurance will accumulate unnecessary fees and leave a gap in your insurance coverage because it won’t protect you if the unexpected happens.